PROCESSING. PLEASE WAIT...

White Paper: Stratman Solutions

Compliance for CECL is closing in.

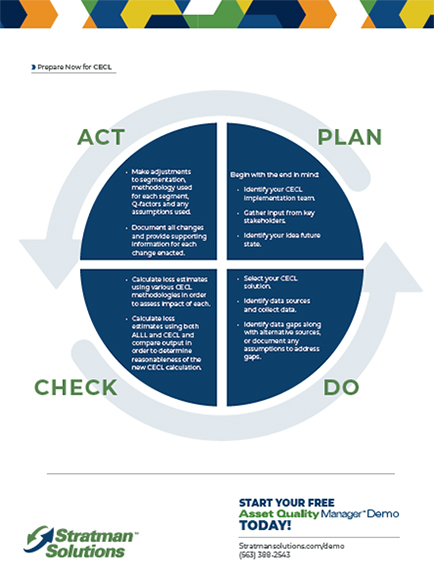

To ensure your institution is prepared, it is critical to begin preparations now - if you have not yet done so. Top financial accounting firms recommend that Financial Institutions (FI) run their existing allowance calculations in parallel with their selected CECL solution (i.e. spreadsheet or third party software) for a period of time. This recommendation, of course, assumes that FIs have already overcome the major hurdle of choosing a CECL solution (and associated methodologies) for calculating current expected credit losses. For many institutions, researching and selecting a third party solution to establish initial CECL compliance and reporting can be nearly as arduous as the new regulation.

Because the standard for CECL compliance is not prescriptive (i.e. there is no “specific methodology” that must be followed), many institutions have adopted needlessly complex solutions with multiple inputs that are likely to become burdensome to maintain long term. On the other end of the spectrum, FIs have developed Excel based solutions (in house or by working with advisors), that are not only labor intensive to maintain, but offer limited functionality. Still other institutions are seizing this opportunity to improve their data gathering, data retention and data mining & analytics capabilities. In whole, it appears the level of disparity in approaches to CECL compliance is equal only to the number of CECL solutions proffered by third party vendors.

With this level of “noise” surrounding the CECL regulation, it’s easy to understand why some institutions have reached “analyses paralysis.” As with any new regulatory edict, the most effective path forward to ensure compliance by the January 2023 deadline, is a common sense approach. Each FI should look for a solution that: (1) offers multiple methodologies thereby providing future options and flexibility to determine the impact of each method; (2) is simple to implement - minimizes disruptions; (3) is easy to maintain long term; and (4) is scalable - to meet your future needs.

At Stratman Solutions, we began our “CECL” journey with a common sense approach. We developed a solution that could both support our current reporting and compliance needs, and also provide the flexibility we’ll need in the future. Early in our journey, we determined we wanted more than an automated calculation/ reporting tool - only used on a quarterly basis. We wanted a notable return on our data collection and data mining efforts. To that end, we included asset management and asset (action) planning features within our CECL solution. Once finalized, we appropriately named our CECL solution “Asset Quality Management (AQM).”

2026 All Rights Reserved | by: www.ciowhitepapersreview.com

2026 All Rights Reserved | by: www.ciowhitepapersreview.com